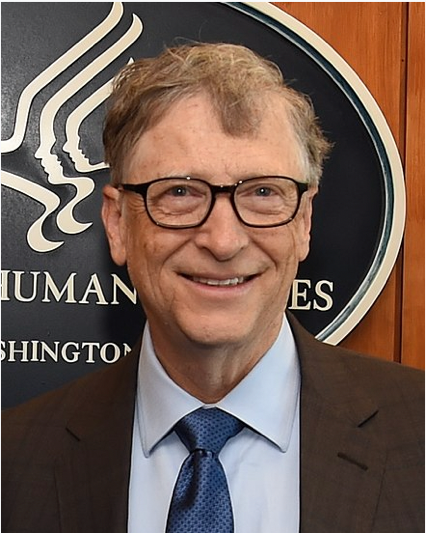

Maximize Your Earnings: The 4 Essential Lessons from Bill Gates on Salary Planning

Maximize Your Earnings: The 4 Essential Lessons from Bill Gates on Salary Planning

Do you have a constant nag that you’re not doing the right thing with your money?

A 2021 Charles Schwab survey found that 65% of people who had a written financial plan felt confident and more financially secure. 44% of the planners felt sure about achieving their financial goals. However, only 40% of non-planners had some assurance they were financially secure. And, only 18% of these non-planners felt they could reach their goals!

So, if a good financial plan can relieve you of a lot of anxiety, the next question to ask is, “What’s the best way to spend my salary?”

Bill Gates and his friend founded Microsoft in 1975. Today Microsoft is one of the biggest firms in the world. How did two college dropouts manage to build such a ginormous empire? Was it solely their technical genius? Or, was it also their brilliant financial management?

If you check the history of Microsoft, Bill and his friend didn’t go to any angel investors. Bill was actually very smart with his money. A lot of what he earned, he pumped back into his business. Clever management of his company and his finances took Bill from being a nobody to the billionaire he’s today.

So what exactly did he do to become a billionaire? Read on.

He did some clever financial planning

In the initial stages, if you have to grow your business solely from the income you get from it, you’re going to need a genius financial plan. Think about it. Your monthly expenses are a big chunk. Add to that the cost of running a business, salaries, marketing costs and many other things. Unless Bill didn’t play his financial card smartly, he wouldn’t be this billionaire today.

So how can you be wise with your money? Break your salary into chunks.

A lot of experts say that you should split your salary in the 50:30:20 proportion. What this means is 50% of your salary goes to meeting all your expenses. 30% goes to investing and saving for the future and 20% goes to recreation.

Others prescribe a 70:20:10 ratio.

So, the point to take away: have a clear-cut financial plan in which you divide parts of your income for every aspect of your life.

He was very frugal

Bill worked hard and ensured that his firm was on its feet. But he was also extremely careful with how he spent his money. He didn’t become lethargic when he got his first profitable contract.

He once revealed that in the first five years of Microsoft, he checked every line of code that was written in the company himself! You know, he could have hired another person to do this extremely difficult task. But he insisted on doing it himself.

Also, despite his success, he didn’t buy himself a private jet. In fact, he didn’t even travel business class. Until 1997 he only flew economy class! This is astonishing considering the amount of money he was making. Even today he’s known for his modest lifestyle.

Here’s a big lesson for many. Be frugal. Live within your means. Better still, live below your means. Instead of splurging all your money in haste, be patient. Most things in life you can’t have immediately. You have to work for them. Once you know you’re stable, that’s the time to indulge.

Also note that, unlike many billionaires, Bill never went broke even before the success of Microsoft. Apply this to your life. Never borrow so much money that you accumulate debts and are unable to repay.

He kept himself prepared for emergencies

In an interview with Ellen Degeneres, Bill said he was always careful with his money. He said he wanted to have large savings because he wanted to have enough to pay salaries to all his employees in case there was a drop in the company’s income. He didn’t want to be caught unawares. He wanted to be well-prepared for emergencies.

Now that’s a lesson for everyone. Set apart an amount for emergencies. Get insurance. Keep a little stashed away in liquid form. Credit cards are dreadful as loan vehicles. But they’re great for emergencies. So, make use of them.

Therefore, when you prepare your financial plan, make sure you’re putting aside something for emergencies.

He invested wisely

Bill knows that the way to make his money grow is to invest it. And he’s proved himself to be a very smart investor. Go and take a look at his portfolio.

See how diversified it is. He’s invested in a whole lot of sectors right from real estate to biotechnology to financial services to agriculture.

How does he know where to invest? He’s an avid reader and a passionate learner. He reads a new book almost every week and ensures that he’s up to date with current trends. This puts him in a place to predict how things can turn out in the economy, what sectors will do well in the future and what companies he should invest in.

This is a huge lesson for anyone trying to establish themselves in life. Invest. Invest rather than save. And invest wisely.

If you aren’t allocating a part of your income to invest, you’re making a huge mistake. And if you aren’t spending time learning about investing, you’re not going to make much on your investments.

So, look at this seriously. Go and find ways to educate yourself about investing. Look at traditional as well as alternative investment options. You should surely have a personalised plan for investing.

His life now

Bill has been as successful as anyone can get in their life. His firm has been at the cutting edge of innovation and has created thousands of jobs worldwide.

Bill stepped down as chairman of Microsoft in 2014. He now involves himself in charity helping the desperately poor with a better life. As you can see, none of this would’ve been possible if hadn’t played his finances right.

You can get here too if you’re smart with your money.