7 Compelling Reasons to Create a Financial Plan from Day One of Your Earning Journey

7 Compelling Reasons to Create a Financial Plan from Day One of Your Earning Journey

You just cashed your first paycheck. The world is full of rainbows and sunshine and that ps5 is finally within your grasp. But why is everyone asking you to save up and invest? Can’t we just leave that for our 30s or maybe 40s?

No! Now, people are talking about investing your money and having financial goals. What do you do? You are starting to feel confused and frustrated trying to understand where to even begin.

So, where do you start? Are financial goals truly essential so early in life? Does it even make a difference to do your financial planning at the beginning of your career? Let’s see.

Financial Planning — A Better Life

We can all agree that when you plan, you are more in control. Good financial planning makes you feel you are in control of your money, and not your bills.

Once you have your financial life in order things become clearer. Then, achieving personal & professional success becomes easier.

Managing your finances determines the quality of your life. Everyone has a dream to live a certain way. No one wants to be struggling to pay off a debt or not be able to buy the things they want.

A financial plan may seem like a vague solution or too cliche, initially. Yet, it is the best way to get you what you need for yourself and your future.

Financial Planning Early in Life — More Stability

A survey by Charles Schwab found that 65% of people who had a written financial plan felt confident and more financially secure. And 44% felt sure about achieving their financial goals.

Whereas, only 40% of non-planners had some assurance they were financially secure. Plus, only 18% of those who did not have a plan felt they could reach their goals!

When you have a financial plan uncertainty reduces, and you feel stable and confident.

Financial Planning — Better Investment Portfolio

A good financial plan will have a section for investments. Making a financial plan helps you clearly see your present situation and understand your risk tolerance. You will also know the timeframe you need to achieve your financial goals.

This positions you to come up with an investment portfolio custom-built to suit you. Your portfolio can take care of your short-term and long-term goals, best returns and liquidity.

Financial Planning — Better Spending Habits

Once you land a job and start earning, you feel you have money to spend. So you can begin developing either good money habits or bad money habits. Usually, in the initial months, everyone tries to save and follow a plan.

But, with so much stuff to buy and so many ways to spend, you could be spending more than 50% of your salary on frivolous shopping and unnecessary splurges.

But people with a financial plan and consistently following it build better spending habits. Even though they have the power to spend their financial plan keeps them on track.

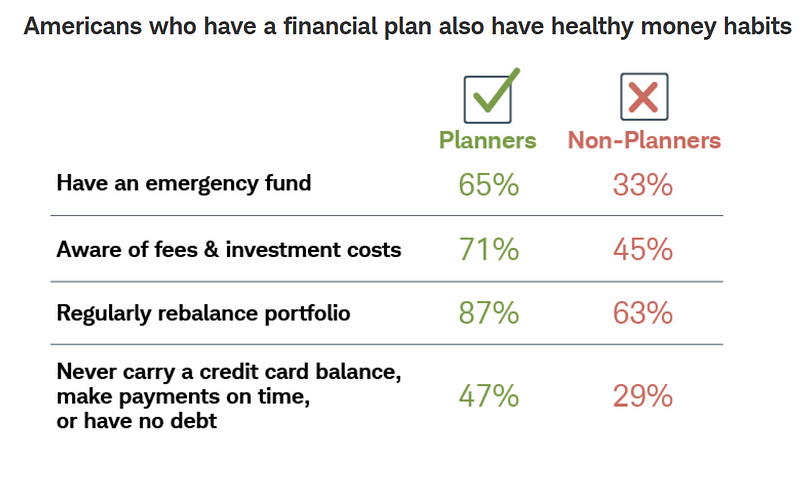

The below survey by Schwab helps you to understand how planners are well-informed and have healthy money habits.

Source: 2021 Schwab Modern Wealth Survey

Financial Planning — Debt-Free Life

Repaying debts or loans halts many dreams for young people. The bitter truth: although you have money in your hands it may take several years to fulfil your dream of buying a home, going on a big vacation, or even buying a good car. So young people usually go for credit cards and easily available loans.

But, as commitments and responsibilities increase, you will need money for immediate needs. You become unable to spend with ease. That’s when you feel like you have a string around your neck, that’s always pulling you back because of your debts.

If you tend to drag on without paying your debts — the pile will become too big and you may end up a debtor for the rest of your life.

The best thing to do — financial planning. Financial goals help you know how much you need to borrow, when you need to take a loan or if you even need a loan. They keep you on track with full awareness of your financial status.

With a good financial plan, you can achieve your dreams at the earliest, and live debt-free and stress-free. You will be at liberty to spend your earnings on what really matters and not be repaying your creditors.

Financial Planning — Retiring Early

Yes, it’s true. You need to think about your retirement right from your early 20s.

The good part is the days when people had to slog until their 60s in jobs they don’t enjoy are pretty much out of the window. The world has changed and almost every fourth person has two or three main streams of income. Retiring early has become a way of life in the post-modern world, especially after the 2000s.

If you are seeking early retirement, then financial planning at the beginning of your career is the best and only option you have.

To retire early, you need to have a clear-cut plan for long-term investments. How can you know where you are in your finances, how much you can invest and how much you need to invest without financial planning?

So, whether you want to retire early or want a long career because you enjoy your job, a financial plan is what you need.

Financial planning — For Emergency Protection

Nobody likes to face a crisis. Unfortunately, emergencies do happen. With financial planning, you can set apart a portion of your income for such situations so that you are not caught off-guard.

Even if it isn’t for you, if a friend or a family member has a need you will be able to help them out.

When you sit down and build a plan for your money, 100% you will be forced to include emergencies in your list. And when you stick to your plan, in a short while, you may have a neat sum of money that you may well be able to use for something else!